As chiropractic students, we are not blind to the financial burden always lurking in the back of our minds. Chiropractic school generally costs roughly 150K, and that’s not including housing, food, or even post-finals week drinks. Chiropractic students do not get the same benefits other post-graduate medical professionals to do when it comes to student loan forgiveness programs, refinancing options, and other help that may be offered. That’s a topic for another day.

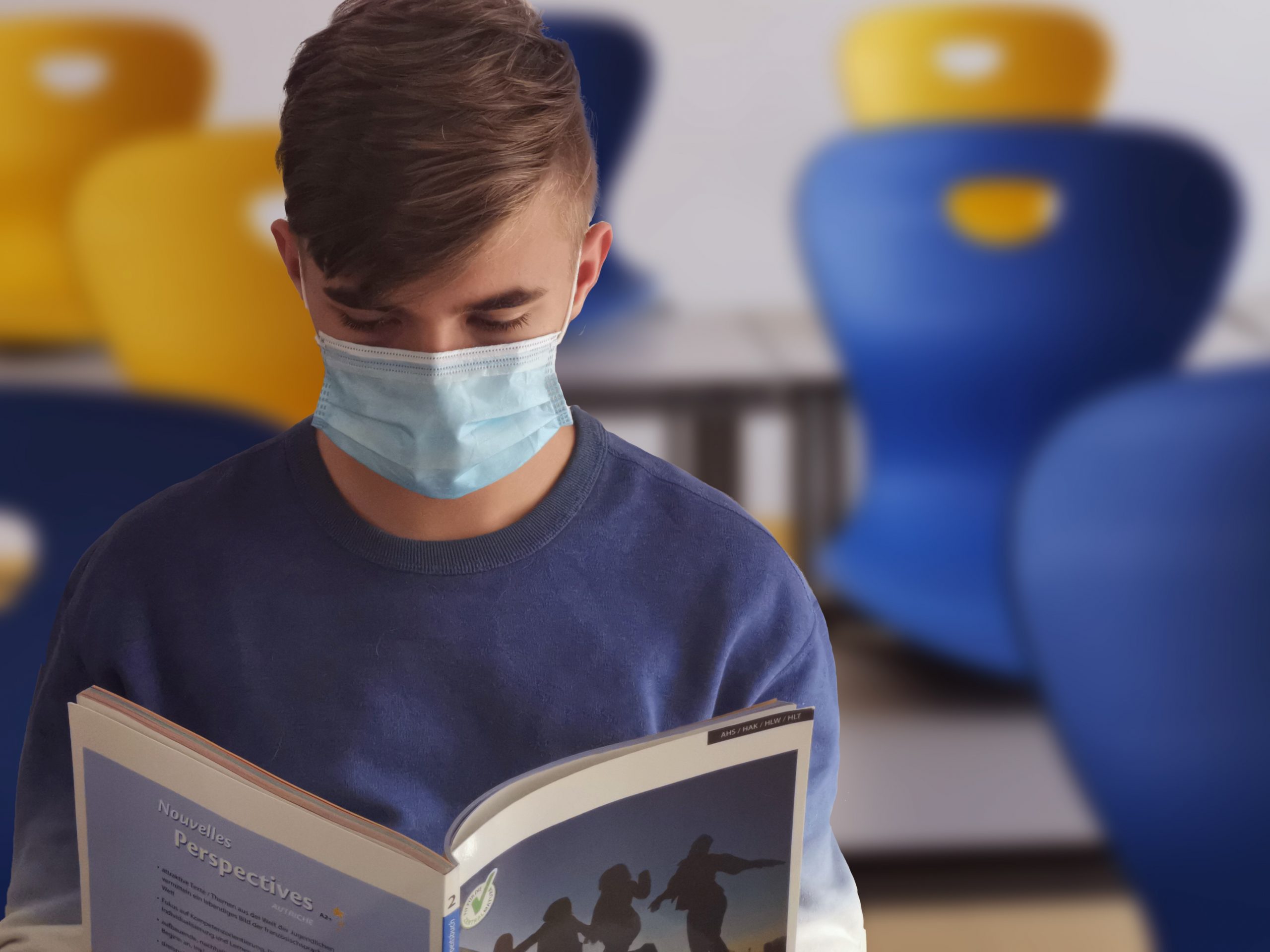

This pandemic has changed the way we view and partake in education. It has certainly made our hips tighter, our necks hurt, and our eyes feel like they’ve been staring at the sun all day even though none of us have been outside in months. Many of us now have limited hours to work, limited clinical hours, even more, limited hours to sleep. The negative impacts of this pandemic have been critical in the breakdown of our mental health and crucial in building our adaptability and perseverance to make it to the light at the end of the tunnel that is graduation.

COVID Positive. No, not That Kind.

With that being said, one positive that has come out of this pandemic is that student loans are not accruing interest. For almost a year now we have been blessed with 0% interest on federal loans! Phew, a small temporary relief that in the long run does make a difference. That’s a few hundred dollars to spend on a portable table, or continuing ed classes, or medkit parts, or a charcuterie board. This is a judgment-free zone and it has been quite a year. Do yourself a favor and bask in the happy little accidents mixed in with this pandemic. What’s even better is this 0% interest has been extended to September 30th, 2021.

But, I’m not a Current Student, Should I care?

If you’re already graduated, you’re in luck too! Not only are you not enduring the pains of being in a mostly online chiropractic school during a pandemic, but you also don’t have to make payments on your loans and your interest isn’t accruing. Defaulted loans also are not being collected. If you’re struggling right now financially, this is hopefully a bit of consolation. If you’re lucky enough that you have a profitable practice or at least a steady job in the field, now is a good time to splurge on your student loans if you have the means to do so. I’m not suggesting the whole “stop eating lunch out once a week to save X amount of dollars” ploy. No. Self-care is important. If you want that smoothie, buy that smoothie. I am suggesting, however, to help yourself in the long run and try to make a dent in the seemingly never-ending tug of war battle with your student loans.

I hope this little brain blurb of mine was helpful. Overall, while these are trying times small consolations as such can go a long way. Look on the bright side, you can get that extra shot of espresso now!

Cheers to the future,

No Comments